Complete Guide: How to Save on Household Expenses

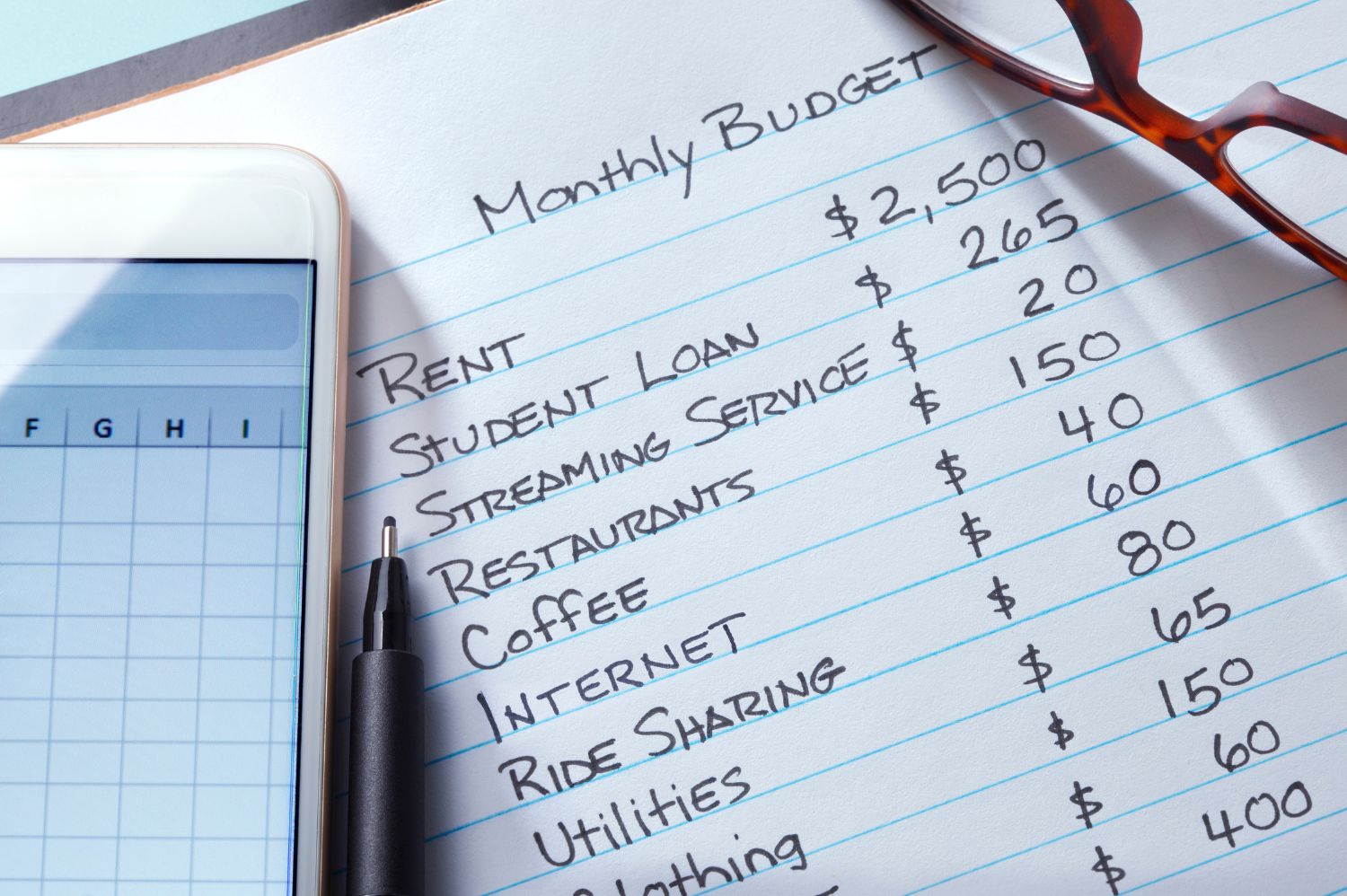

Managing household expenses can be challenging amid the rising costs of modern life.

However, with careful planning and some smart strategies, it’s possible to save significant money on your daily expenses.

In this content, we bring a variety of useful tips and habits to help you reduce household expenses and maximize your family budget.

Let’s explore practical ways to save in different aspects of daily life, allowing you to achieve your financial goals more easily.

Tips on How to Save on Household Expenses

Managing household expenses efficiently is essential to maintain a balanced budget and achieve financial goals.

However, it can often seem challenging to find ways to save without compromising comfort and quality of life.

For this, we have gathered some ways to save in different aspects of daily life. Follow along with us!

Save Energy:

Saving energy not only reduces your utility costs but also benefits the environment. Here are some ways to save energy at home:

- Turn Off Lights and Electronics: Turn off lights and electronic devices when not in use. The simple habit of turning off lights when leaving a room can result in significant savings over time.

- Switch to LED Bulbs: LED bulbs consume less energy and last longer than traditional incandescent bulbs. Although the initial cost may be slightly higher, the long-term savings are worth it.

- Use Energy-Efficient Appliances: When buying new appliances, look for models with high energy efficiency ratings. More efficient appliances consume less energy, translating into savings on your utility bills. Additionally, consider investing in energy-efficient improvements such as thermal insulation and energy-efficient windows to further reduce energy consumption.

Plan Meals and Shop Smart:

Planning meals and shopping smartly not only saves money but also helps reduce food waste. Here are some tips to save money on grocery shopping and avoid food waste:

- Plan Meals in Advance: Take time to plan your meals for the week. By planning your meals in advance, you can create a specific shopping list and avoid impulse purchases.

- Buy Fresh and Seasonal Foods: Fresh and seasonal foods are usually cheaper than out-of-season foods. Additionally, they tend to be tastier and more nutritious.

- Take Advantage of Discounts and Promotions: Keep an eye on discounts and promotions at your local grocery store. Many stores offer discounts on quick-sale items or in bulk.

- Reduce Food Waste: Properly store food to prolong its shelf life and make the most of leftovers. Use leftovers to create new meals or freeze for later use.

Reduce Housing Expenses:

Look for ways to reduce housing costs, such as renegotiating rent or refinancing a mortgage to get lower interest rates.

Consider sharing housing with a roommate or renting out unused spaces in your home to generate additional income.

Additionally, make small changes in your home, such as installing water-saving devices and low-flow faucets, to reduce water and sewer costs.

Minimize Entertainment Expenses:

Look for economical alternatives for entertainment, such as taking advantage of free community events and opting for outdoor activities like hiking and picnics instead of activities that require significant spending like dining out and going to the movies.

Or even use streaming services instead of expensive cable TV subscriptions.

Additionally, make the most of discount cards and loyalty programs to save on tickets and leisure activities.

Use Economical Transportation:

Reducing transportation costs is an effective way to save money daily. Here are some strategies for using economical transportation:

- Walk or Bike: If possible, opt to walk or bike for short distances. In addition to saving money on fuel or public transportation fares, you’ll also be exercising and contributing to pollution reduction.

- Use Public Transportation: Public transportation is often more economical than driving a private car. Check for bus, subway, or train options available in your area and use these services to save money on daily commutes.

- Carpool: Arrange carpooling with coworkers, friends, or neighbors who have similar routes. Carpooling not only reduces fuel and parking costs but is also a socially responsible way to reduce environmental impact.

- Maintain Your Vehicle Properly: Perform regular maintenance on your vehicle to ensure it runs efficiently. Keeping tires inflated, regularly changing the engine oil, and performing periodic maintenance checks can help reduce long-term operational costs.

By adopting these practices, you can significantly save on transportation costs and use your money more efficiently.

Reduce Communication Expenses:

Evaluate your cell phone, internet, and cable TV plans to identify cost-saving opportunities.

Consider switching to more economical plans, negotiating rates with your service provider, or even cutting unnecessary services to save money.

Additionally, make the most of free communication apps and services to stay in touch with friends and family without spending much.

Create an Emergency Fund:

Establish the habit of regularly saving a portion of your income for an emergency fund.

Having an emergency fund can help avoid accumulating debt in case of unforeseen events such as unexpected medical expenses or job loss.

Set aside a fixed amount from each payment for this fund and avoid touching it unless absolutely necessary.

Saving on household expenses is essential to achieving financial stability and ensuring a secure financial future.

By adopting smart saving habits and implementing practical cost-reduction strategies in your daily life, you can optimize your family budget and achieve your financial goals more easily.

Remember that small changes can have a significant impact over time, so start implementing these tips today and reap the benefits of a more economical and balanced life.